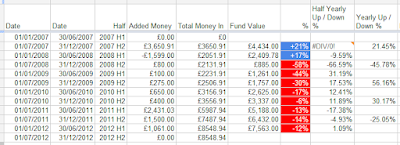

That figure for 2011 is a 25% loss. This is bad. Following two very good years in 2009 (up 56%) and 2010 (up 30%), this is a big shock. Mostly I can put it down to a change of stock picking style. I had my head turned by others who bigged up bizarre mining and value stocks all of which have been a disaster: RSM Tenon, Range Resources, Emed and Coal of Africa. Add to that the continued collapse in banking stocks which I was exposed to through the hangover of the RBS purchase in 2007 and another poor buy with Lloyds in 2011.

I'm going to whittle out the rubbish during the course of 2012 and head on back to the asset allocating that was more successful for the previous two years. The overall under-performance can still be mostly pinned down to the large chunk of money stuck in RBS. I'm guessing it'll be 10 years or more before that ever sees a profit.

Here's the run-down in a pretty graph since inception.

The teamdave fund of fun-ness is held in an ISA. All investment decisions are my own and shouldn't be followed by anyone else with half a brain.

No comments :

Post a Comment